SmithRx Claims Intelligence

CONTEXTWhen numbers don't tell the whole story

Member Services (MSS) fielded thousands of pharmacy‑claim calls each month—and nearly 90% carried a rejection or billing snag. Regardless of complexity, every claim stopped at the MSS gate before it could reach Benefit Ops, Clinical, or Admin Super‑Users. Agents pinballed between Laker, Salesforce, and the in‑house Admin Portal while pharmacists fumed on hold. The surge finally broke the model: throwing more people at the phones was fiscally impossible and operationally reckless.

CHALLENGEDiagnostic complexity masquerading as tool complexity

At first glance the fix seemed obvious: three disconnected systems were slowing agents down. Yet one question kept nagging—why was case volume climbing, even during the lull between open‑enrollment cycles when no new employer groups were onboarding? Tickets weren’t closing fast enough and open cases stacked on top of each other. Every claim demanded a dance across Laker, Salesforce, and the Admin Portal before basic triage could begin. Handle times ballooned, backlogs swelled, and pharmacists grew impatient. The workflow felt heavier than the work itself—an unmistakable itch that something deeper was dragging the whole machine. We had to scratch beneath the surface.

DISCOVERYThe breakthrough: diagnosis was the disease

By shadowing agents, mapping workflows, and digging into call data, I learned that agents lost 20–30 minutes per claim just decoding rejection messages. Every claim—whether a quick refill or a more complex prior-auth—paid the same diagnostic tax; it was like standing in a 30-minute amusement-park line without knowing whether you’d end up on the kiddie carousel or the park’s wildest coaster.

Data scrubbed examples of the raw coded system message and claim data that an agent would need to sift through to find the reason the error was triggered. Then they would need to dig into the “rule handlers” to determine what options were available for that particular member. That 30-minute diagnostic tax kept showing up the same way: an agent hunts down a two-digit reject code on one screen, loads system messages, raw code data, and rule handlers on another, then ping-pongs through Slack, Laker, Portal, and, now, Confluence (the internal wiki of processes). The pattern screamed for a deeper cut into the claims data—so I pulled it.

“In Portal, there are 28 different rules for the same code. One rule branches into seven possible matches—48 lines to sift through before I can even decide what to do.”

A single Looker slice blew the lid off: the top twenty reject codes drove 96.39 % of all claim failures—far more concentrated than anyone guessed. Worse, several of those codes (think Refill Too Soon or Patient Not Covered) should have been instant calls, yet still vanished into the three-tool maze.

Fixing a single culprit—code 79 “Refill Too Soon”—would eliminate one-quarter of all rejected claims in one step.In a joint huddle with Clinical, Ops, Plan Benefits, and Engineering, we locked in an initial set of 11 high-impact reject codes for pre-diagnosis—additional codes would roll out in later phases.The Looker snapshot made the problem impossible to ignore, so I pulled Kenny — our VP of Engineering — into a huddle. With Ops, Clinical, and Benefit leads, we sketched a simple promise: “One screen, one decision.” Consolidating the three-tool hopscotch into a single workspace was a table-stakes requirement. The real play was to pre-diagnose every high-volume reject code so an MSS agent could jump straight to triage: resolve here or escalate there.

Total automation was tempting, but agent stories and data showed enough use cases to warrant a human checkpoint. Our goal, then, was to save the “epic quest” for genuinely complex cases and let routine refills and coverage hiccups close out in minutes, not half-hours.

The typical MSS agent case flow prior to the actual case being resolvedTurning a 96% Bottleneck into Leverage

Objective Collapse the 30-minute diagnostic tax without adding head-count by embedding policy intelligence directly in the agent’s workflow (and consolidate into one tool).

-

Tackle the most common codes that cause failures before touching edge cases.

-

Streamline the step—search, form fields, actions—into an optimized flow; one screen replaces three to cut dead air and copy-paste errors.

-

Connect the rule logic behind each recommendation for context

Armed with those four principles, we translated blueprint into pixels—unveiling the Semantic Workspace that turns every claim into a one-screen, one-decision experience.

-

Surface only the necessary rules, patient info, and actions—no mental tab-hopping, no lost seconds.

STRATEGY

PRODUCT DESIGNClaims intelligence that anticipates expertise

The new Admin Portal reframes claim triage as a language problem, not a lookup problem. Each screen now reads the data, chooses the next move, and speaks in the cadence of a seasoned agent. What follows are the three pillars that make that possible.

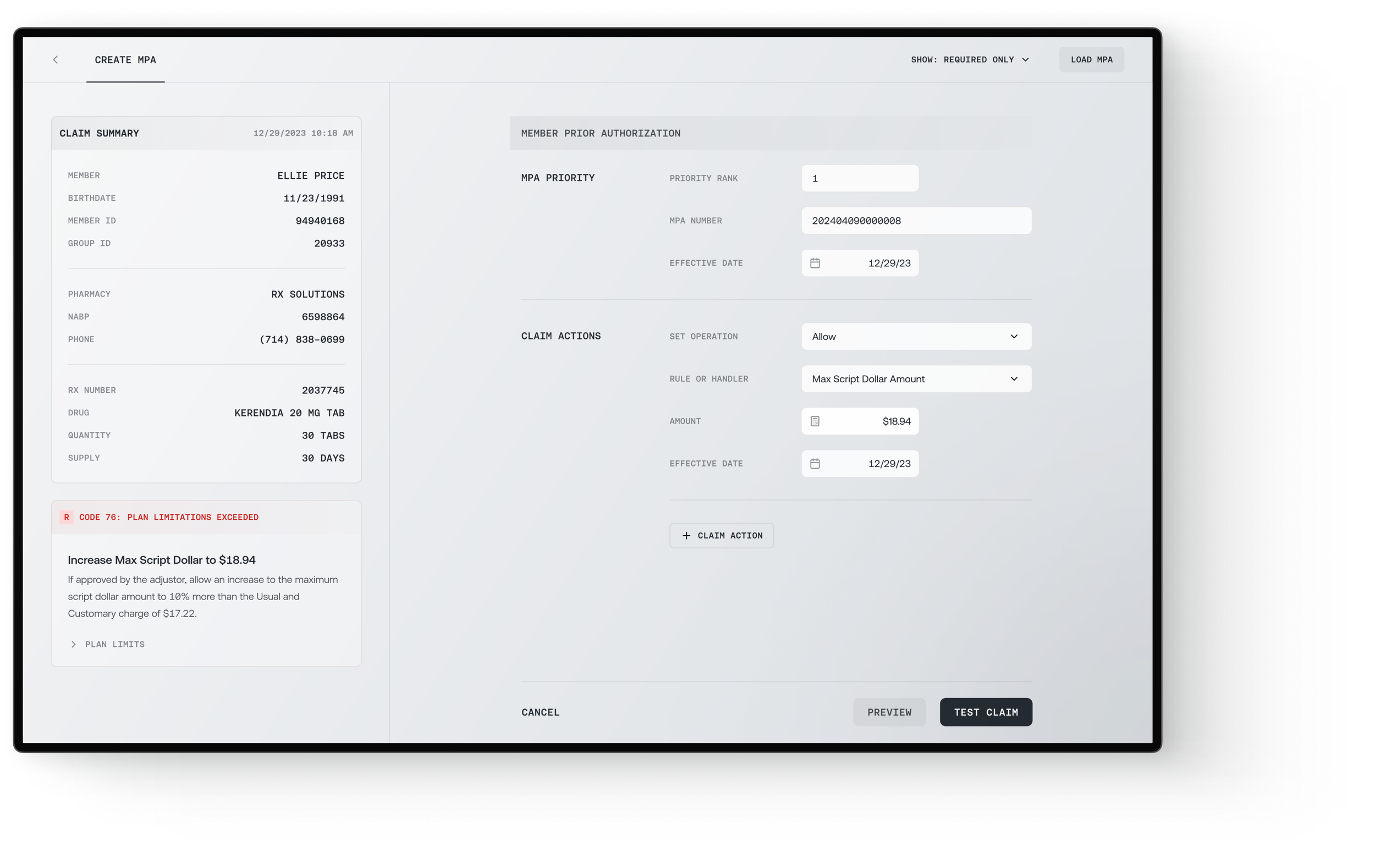

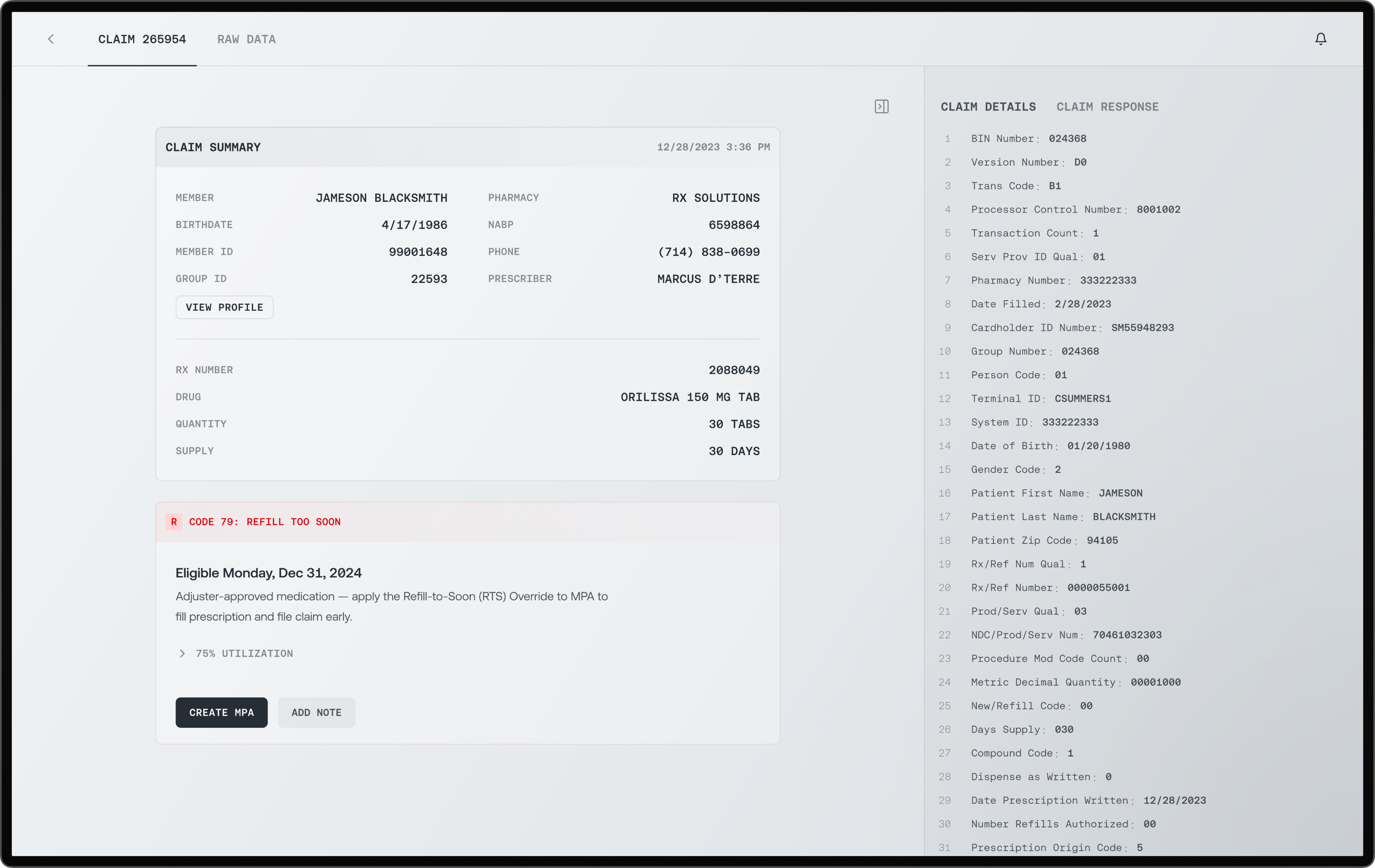

Translating cryptic data into human-first cues. CODE 79 auto-renders the eligible date if one exists, or any possible overrides if available. This example show, Code 79 with an override option.Intelligent code translation

Every claim opens with a semantic strip that swaps cryptic NCPDP jargon for a sentence a human can use on the phone: “Refill too soon — eligible 12 Jan 2025,” “Member not covered — re-check on 1 Aug.” By front-loading meaning, we slash the 20-minute decoding ritual to a glance and let the conversation start where it used to end.

Contextual action flow

Beneath the translation, the card offers a single, pre-filtered control—Create MPA, Test Claim, or Escalate—already wired to the correct handler. Click once and a slim side panel glides in, trimmed to the three fields that matter. Progressive disclosure keeps the space uncluttered; real-time validation instantly changes the response card from red to green the moment the claim is cleared. A task that previously required numerous clicks and multiple tabs can now be resolved in one motion.

Action card surfaces just-in-time controls: Create MPA pre-filters to the correct handler. Add Note keeps the audit trail inline. Utilization/plan-limit accordions stay collapsed until needed.With a single click, the card slides, and a streamlined MPA panel slides into view. The form is already pared to the essentials—only the fields truly required are visible by default, all others tucked away unless needed. The handler dropdown is pre-selected to match the semantic intent, such as “Override · Refill Too Soon.” A built-in “Test Claim” button lets the agent validate the override instantly, without leaving the workspace.

One click slides in a right-panel form with: required-only fields shown by default. Handler dropdown pre-selected (e.g., Override - Refill Too Soon). Test Claim (below) validates the override in-place.The valid Test Claim confirms the override is in effect and ready for the pharmacy to process the transaction. To maintain a cohesive experience, the paid claims are organized in a similar manner with their own contextual actions. Every rejection reason, rule interpretation, and recommended response was designed for immediate comprehension. No more hesitation during live pharmacy calls. No more "let me check another system." The interface built agent confidence through the intelligent presentation of complex logic. For more complicated cases where MSS agents required the raw data for deeper investigations (e.g., rejections that necessitated proof of step therapy), the claim data was reformatted and nested in an expandable drawer for easy access and readability.

Formatted claim details data for better readability in the event an agent does need to dig into the sourceWorkflow-native search

When agents must hunt, search greets them on their terms: Member ID and Rx Numbers are first confined to a specific data or date range. Results echo the same color grammar as the action card, so the mental model never resets. Filters live in plain sight, and each query returns instantly—no type-and-pray delay loops. Search behaves like a conversation, not SQL.

By slimming the table to only the fields agents actually scan, the design taps Hick’s Law to cut choice time, Miller’s Law to keep details digestible at a glance, and Jakob’s Law to align with patterns they already know—so MSS can spot the right claim immediately.

When these three pieces click together, the diagnostic tax disappears: simple cases close in four minutes, complex ones land on the right desk the first time. The Admin Portal doesn’t add manpower; it gives the existing team super-human context, setting the stage for the measurable outcomes that follow.

OUTCOMEFrom confusion to confident expertise

Within 30 days, we achieved total transformation: without the excessive diagnostic tax, we saw claim resolution times drop, and agents reported complete confidence in pharmacy conversations. Semantic intelligence has transformed expensive translation work into strategic problem-solving, giving agents back their agency.

3.82 → 4.85

Satisfaction score increased by over a full point

68%

Claims could be diagnosed, triaged and resolved in under 5 minutes.

7+ Minutes → 30 Seconds

Not only did the time and cognitive burden decrease in diagnosing issues claim issues, the downstream effects dropped wait times from 7+ minutes to less than a minute

REFLECTIONIntelligence principles scaled beyond claims

The initial success validated semantic intelligence as SmithRx's platform philosophy. PMs leading ZEBRA (Joe, Abby, Banders) saw it as proof that interpretive design could transform any complex workflow. The framework influenced future rule engines, automation priorities, and decision-support architecture across the platform. Success created its own expansion demand.